It depends...

We appreciate this may be a frustrating answer but see below so we can explain.

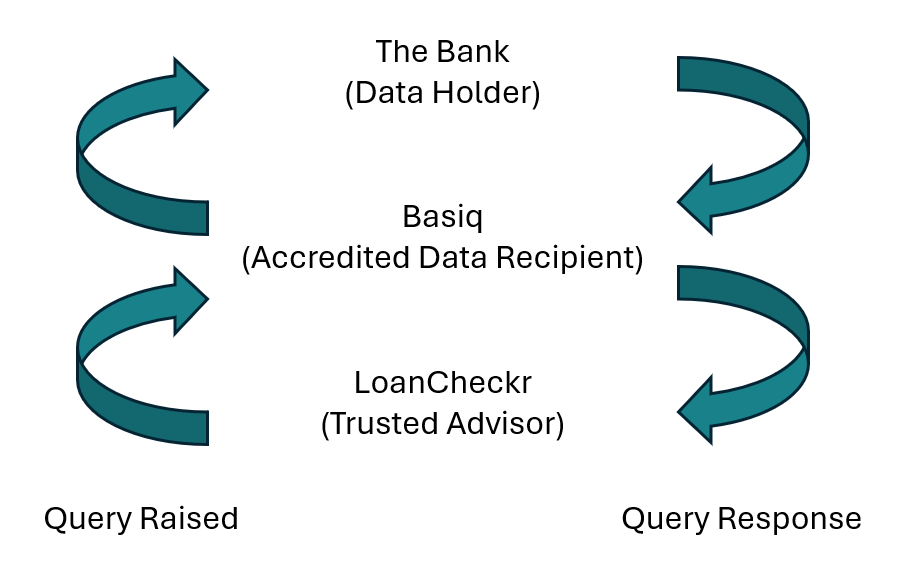

To explain, when an issue is raised, it needs to go through the following three layers to see where the error has resulted from:

- LoanCheckr - We need to do checks and make sure that the issue or error is not something that we are able to fix

- Basiq - This is the company between us and the bank who provide us with the data. They need to also do their own checks to make sure that it is not an error with their software that feeds into us. Basiq is known as an Accredited Data Recipient (ADR).

- The Bank - Particularly when it comes to missing data or data quality, the bank is generally the source. However, they won't review it until LoanCheckr & Basiq have confirmed that they have completed their own checks

- (The Bank's ADR - In a lot of cases, the banks hired ADRs to structure and manage the Consumer Data Right data for them. As such, when there is a data error, bank's will pass the issue onto their ADR who have the technical capacity to manage or fix the issue)

We appreciate that this process can feel frustrating and long-winded, however, this process ensure that someone within those layers is not unnecessarily bombarded with issues that are not to do with them.

The terms used underneath each of the layers are the technical terms used by the various governing bodies that regulate the system. Each of these are also known by their acronym (DH, ADR and TA) in technical documentation.

As for SLAs, it's hard to give one because it depends on what layer the problem is within and whether it is a data fix or a deeper technical issue.

We will always endeavour to resolve issues ASAP, however, we do not control how quickly banks resolve their own data issues. If you feel strongly about this issue, we highly recommend contacting the relevant governing body to make your voice heard.

Here is the ACCC's CDR contact page if you have any feedback for them.

You can also email them directly here.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article